Business Insurance in and around Antlers

One of Antlers’s top choices for small business insurance.

Insure your business, intentionally

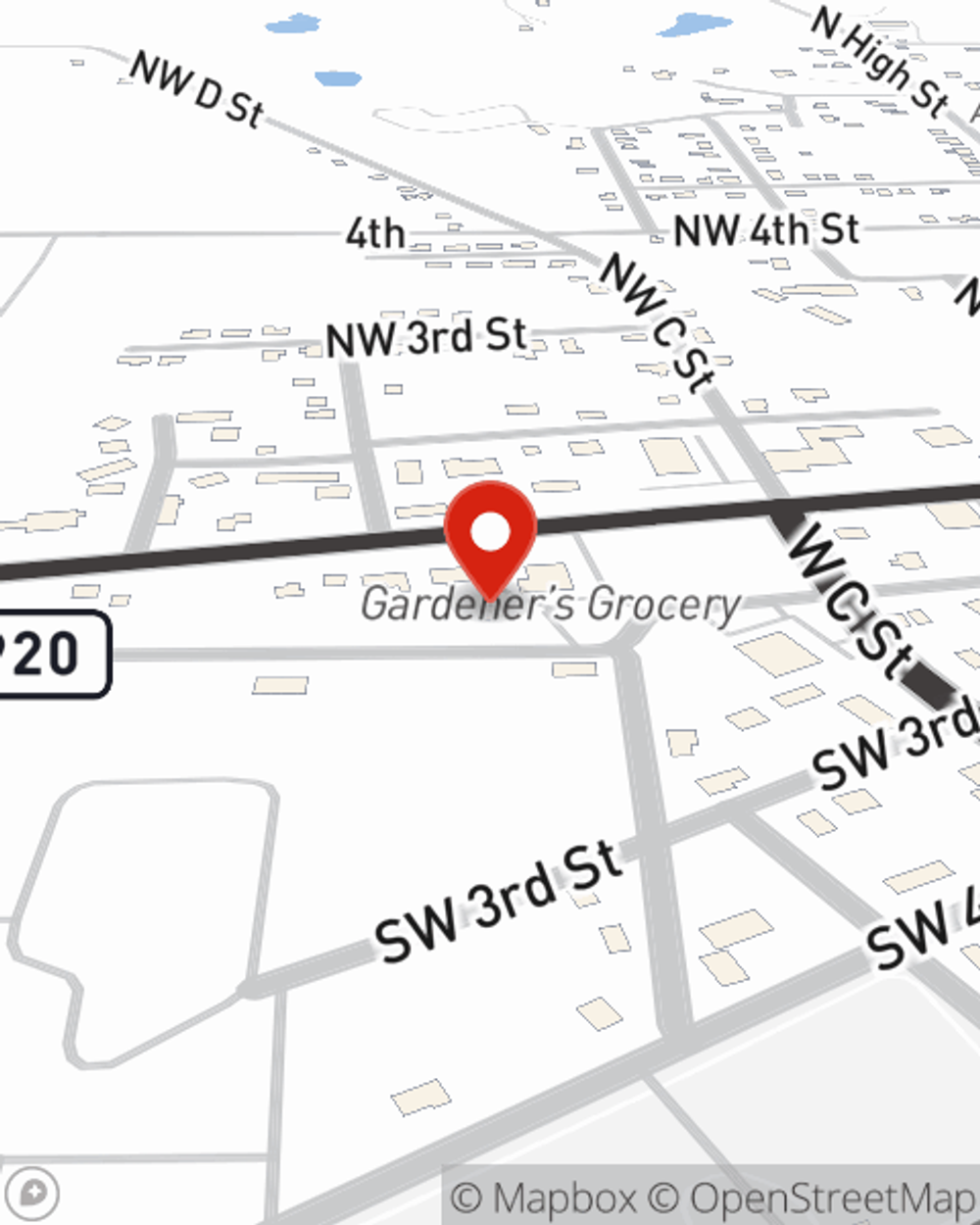

- Antlers, OK

- Rattan, OK

- Clayton, OK

- Boswell, OK

- Hugo, OK

- Atoka, OK

- Lane, OK

- Tulsa, OK

- Stilwell, OK

- Claremore, OK

- Catoosa, OK

- Pushmataha County

- Durant, OK

- McAlester, OK

- Oklahoma City

- SE Oklahoma

- Choctaw County

- Rogers County

- Broken Bow, OK

- Hochatown, OK

- Adair County

- McCurtain County

- Atoka County

- Oklahoma

Your Search For Remarkable Small Business Insurance Ends Now.

Whether you own a a confectionary, a bakery, or a cosmetic store, State Farm has small business insurance that can help. That way, amid all the various moving pieces and options, you can focus on navigating the ups and downs of being a business owner.

One of Antlers’s top choices for small business insurance.

Insure your business, intentionally

Get Down To Business With State Farm

When one is as committed to their small business as you are, it makes sense to want to make sure everything has been thought of. That's why State Farm has coverage options for commercial auto, surety and fidelity bonds, worker’s compensation, and more.

As a small business owner as well, agent Cameron Goodwin understands that there is a lot on your plate. Call or email Cameron Goodwin today to review your options.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Cameron Goodwin

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.